What is the Realization Principle?

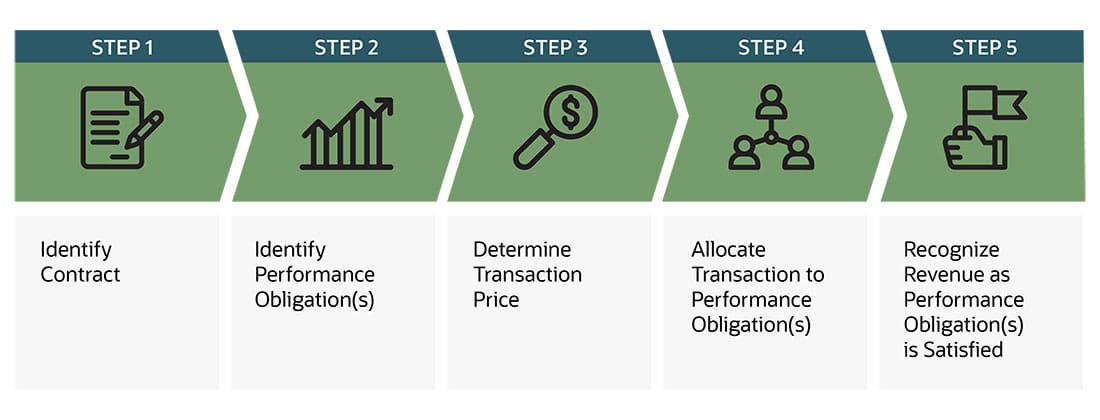

With the IFRS 15 – Revenue from contract with customers comes to effect, the revenue recognition has been divided into five steps called five steps model. Revenue from construction contracts must be recognized on the basis of stage of completion. The realization principle states that revenues are only recognized when they are realized. Similarly, an expense should be recognized when goods are bought or services are received, whether cash is paid or not. Once the company decides on a certain accounting policy it should not be frequently changed.

- This prevents anyone from falsifying records and paints a more accurate portrait of a company’s financial situation.

- The realization concept is important in accounting because it determines when revenue should be recognized.

- And we assume this revenue as realized only when it legally arises to be received.

- The revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned.

Auditor Use of the Realization Principle

International Financial Reporting Standards (IFRS), which are used in over 140 countries, also incorporate the realization principle but with a slightly different approach. IFRS focuses on the transfer of control rather than the transfer of risks and rewards, which is a key aspect under GAAP. This means that under IFRS, revenue is recognized when the customer gains control of the goods or services, which may occur at a different point professional invoice design in time compared to GAAP. This distinction can lead to variations in the timing of revenue recognition, impacting financial statements and potentially influencing business decisions. Revenue accounting is fairly straightforward when a product is sold and the revenue is recognized when the customer pays for the product. However, accounting for revenue can get complicated when a company takes a long time to produce a product.

Company

Any receipts from the customer in excess or short of the revenue recognized in accordance with the stage of completion are accounted for as prepaid income or accrued income as appropriate. Another advanced technique involves the use of fair value accounting for financial instruments. Under this approach, assets and liabilities are measured and reported at their current market value, rather than their historical cost. This method is particularly useful for companies dealing with investments, derivatives, and other financial instruments that fluctuate in value. By using fair value accounting, businesses can provide a more timely and relevant picture of their financial position, which is crucial for stakeholders making investment decisions.

GAAP Supports Revenue Recognition Standards

The delayed payment is a financing issue that is unrelated to the realization of revenues. However, losses even those not realized but with the remote possibility of occurring should be included in the financial statements. So all losses are recognized – those that have occurred or are even likely to occur. Every organization, according to its needs, chooses a specific period of time to complete an accounting cycle. Deferred revenue is a liability that represents the future obligation of a deliverer to deliver goods and services, even though the deliverer has already been paid in advance. When the delivery occurs, the deferred revenue account is adjusted or removed, and the income is recognised as revenue.

What is the difference between accrued and realized revenue?

Revenue recognition is generally required of all public companies in the U.S. according to generally accepted accounting principles. In many cases, it is not necessary for small businesses as they are not bound by GAAP accounting unless they intend to go public. Another is the matching principle, which states that revenue and all related business expenses should be recorded during the same accounting period. For one, the principle and its corresponding ASC 606 framework give CFOs and accounting teams the tools to accurately portray their companies’ financial performance and health. According to the realization principle, the revenue is recognized at the time of the sale.

Accounting Period Concept

Where a company receives cash in advance for which goods or services are to be provided at a future date, it initially debits cash and credits unearned revenue (also known as prepaid revenue). Unearned revenue is a liability that is subsequently converted to earned revenue when the related goods or services are provided to customers. It is done by debiting unearned revenue (or prepaid revenue) and crediting revenue. The revenue is referred to as “realized” when goods are sold or services are provided in exchange for cash or claims to cash (i.e., accounts receivable). It is referred to as “realizable” when goods or services are provided in exchange for a noncash asset that is readily convertible into cash without incurring any additional costs.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. As another example, consider that Mr. A sells goods worth $2,000 to Mr. B. The latter consents that the goods will be transferred after 15 days. So the indefinite life of an organization is divided into shorter, generally equal time period. This facilitates a comparison of performances and allows stakeholders to get timely information.

As a result, many businesses use the accrual basis of accounting, which records revenue when it is earned, regardless of when the customer pays. While this approach can smooth out cash flow fluctuations, it does not provide as accurate a picture of revenue as the completed service method. Ultimately, the best method for recording revenue will depend on the specific needs of the business. The revenue recognition principle, a feature of accrual accounting, requires that revenues are recognized on the income statement in the period when realized and earned—not necessarily when cash is received.

In other words, companies shouldn’t wait until revenue is actually collected to record it in their books. This is a key concept in the accrual basis of accounting because revenue can be recorded without actually being received. This principle ensures that revenues are recorded in the same accounting period as the expenses incurred to generate them, providing a coherent and comprehensive view of a business’s profitability. It also ensures that companies don’t prematurely recognize revenue or delay its recognition, both of which could distort the true financial performance of the entity. Realization accounting is grounded in the principle that revenue should be recognized only when it is earned and measurable. This approach ensures that financial statements reflect the true economic activities of a business, rather than merely recording transactions as they occur.

Leave a Reply

You must be logged in to post a comment.