Degree of Operating Leverage: Formula, Example and Analysis

Operating leverage is the ratio of a business’s fixed costs to its variable costs. This ratio is often used when forecasting sales and determining appropriate prices. While the potential for increased profitability with high operating leverage is appealing, weighing that against the risks is essential. It’s always a good practice for businesses to calculate the degree of operating leverage periodically, ensuring they’re not overly exposed to the pitfalls while reaping the benefits. A degree of operating leverage is a financial ratio that can help you measure the sensitivity of a company’s operating income.

What are the limitations of using DOL?

As a company generates revenue, operating leverage is among the most influential factors that determine how much of that incremental revenue actually trickles down to operating income (i.e. profit). High operating leverage means that small changes in sales can lead to significant changes in operating income. This can be beneficial when sales are increasing but risky when sales are declining. If you try different combinations of EBIT values and sales on our smart degree of operating leverage calculator, you will find out that several messages are displayed. For example, a DOL of 2 means that if sales increase (decrease) by 50%, operating income is expected to increase (decrease) by twice, i.e., 100%. Understanding DOL allows managers to make informed decisions about pricing, production, and investment by evaluating the potential impact of sales fluctuations on profitability.

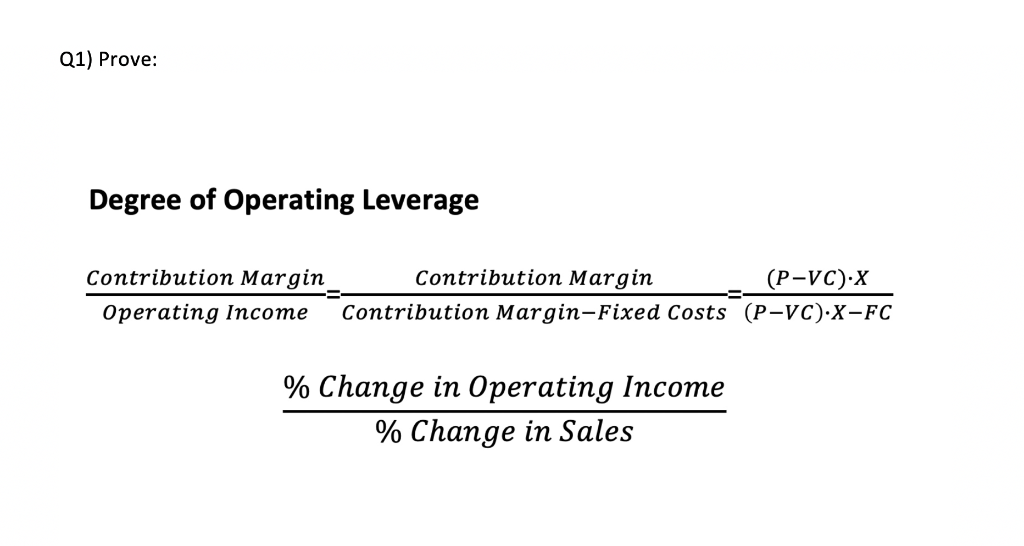

How to Calculate the Degree of Operating Leverage (DOL)?

The degree of operating leverage (DOL) is a multiple that measures how much the operating income of a company will change in response to a change in sales. Companies with a large proportion of fixed costs (or costs that don’t change with production) to variable costs (costs that change with production volume) have higher levels of operating leverage. The DOL ratio assists analysts in determining the impact of any change in sales on company earnings or profit.

Great! The Financial Professional Will Get Back To You Soon.

We put this example on purpose because it shows us the worst and most confusing scenario for the operating leverage ratio. Variable costs vary with production levels, such as raw materials and labor. Fixed costs remain constant regardless of production levels, such as rent and insurance. Alternatively, a company with a low DOL typically spends more money on fixed assets to increase its sales. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

For example, for an operating leverage factor equal to 5, it means that if sales increase by 10%, EBIT will increase by 50%. To determine whether your business has a high or a low DOL, examine your organisation’s performance compared to other organisations. However, you should not be referring to every industry as some might have higher fixed costs than other industries. For instance, a 10% increase in sales for a company with low DOL might result in a less than 10% increase in EBIT, indicating a more stable, albeit less responsive, profit scenario.

However, companies rarely disclose an in-depth breakdown of their variable and fixed costs, which makes usage of this formula less feasible unless confidential internal company data is accessible. On that note, the formula is thereby measuring the sensitivity of a company’s operating income based on the change in revenue (“top-line”). So, whether you’re a seasoned financial pro or a business owner looking to optimize profitability, keep this guide handy. With the right tools and understanding, you can leverage your fixed costs to drive financial success.

- Financial and operating leverage are two of the most critical leverages for a business.

- Companies with low operating leverage experience smaller fluctuations in EBIT with changes in sales.

- A company with a high DCL is more risky because small changes in sales can have a large impact on EPS.

- Companies with low DOL will have low fixed expenses and more variable costs, which increases the operating profits.

Just like the 1st example we had for a company with high DOL, we can see the benefits of DOL from the margin expansion of 15.8% throughout the forecast period. In the final section, we’ll go through an example projection of a company with a high fixed cost structure and calculate the DOL using the 1st formula from earlier. Despite the significant drop-off in the number of units sold (10mm to 5mm) and the coinciding decrease in revenue, the company likely had few levers to pull to limit the damage to its margins.

Additionally the use of the degree of operating leverage is discussed more fully in our operating leverage tutorial. Use the DOL calculation to support pricing decisions for your products massachusetts state tax information or services. A higher DOL suggests that any price changes will have a magnified effect on your profits. Determine the optimal pricing strategy by considering the DOL and its implications.

In other words, any increase in sales might cause an increase in operating income. Even if sales increase, fixed costs do not change, hence causing a larger change in operating income. If sales revenues decrease, operating income will decrease at a much larger rate.

Leave a Reply

You must be logged in to post a comment.